More insurance carriers in Virginia are offering genuine manufacturer parts guarantee on auto insurance, motorcycle insurance, RV insurance, and boat…

More insurance carriers in Virginia are offering genuine manufacturer parts guarantee on auto insurance, motorcycle insurance, RV insurance, and boat…

So you’re at the dealership signing paperwork for your new vehicle. The finance rep goes over your monthly payments and…

We’re almost half way through 2022 and most of the daily headlines can be summed up with one word: inflation….

Whether you’re ready to embrace insurance telematic programs or not, they are here and here to stay. Snapshot | Intellidrive…

Think about the last time you purchased a car, a home, furniture, or even dinner. You had a lot of…

As we roll into the new year there is a common theme across the globe—inflation. What started out as a…

When looking around for auto insurance there are numerous coverage options for you to choose. One commonly selected coverage is…

A new year is here and 2022 is already starting off with a different feel. As I’m currently writing this…

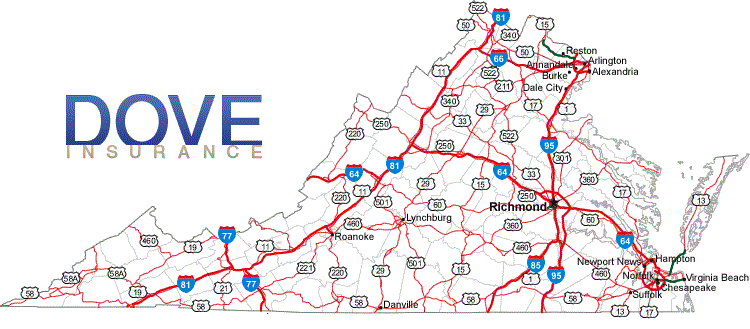

If you are in need of a SR-22 or FR-44 filing in Virginia we can help. Finding insurance and helpful…

The Virginia state minimum coverage for auto insurance liability will increase starting in 2022. SB 1182 passed the Virginia Senate…