Single wide, double wide, and manufactured homes are a great and affordable way to homeownership. And since purchasing property is…

Single wide, double wide, and manufactured homes are a great and affordable way to homeownership. And since purchasing property is…

Filing a claim on your Virginia homeowners insurance policy can be a little startling, especially if you’ve never filed a…

Based on statistics published by the III, water damage and freezing are together the second-most common causes of property damage…

According to Bankrate, the national average for home insurance based on $250,000 in dwelling coverage is $1,428, up 20% from…

The insurance industry is going through some significant pricing changes as inflation and the overall cost of doing business continues…

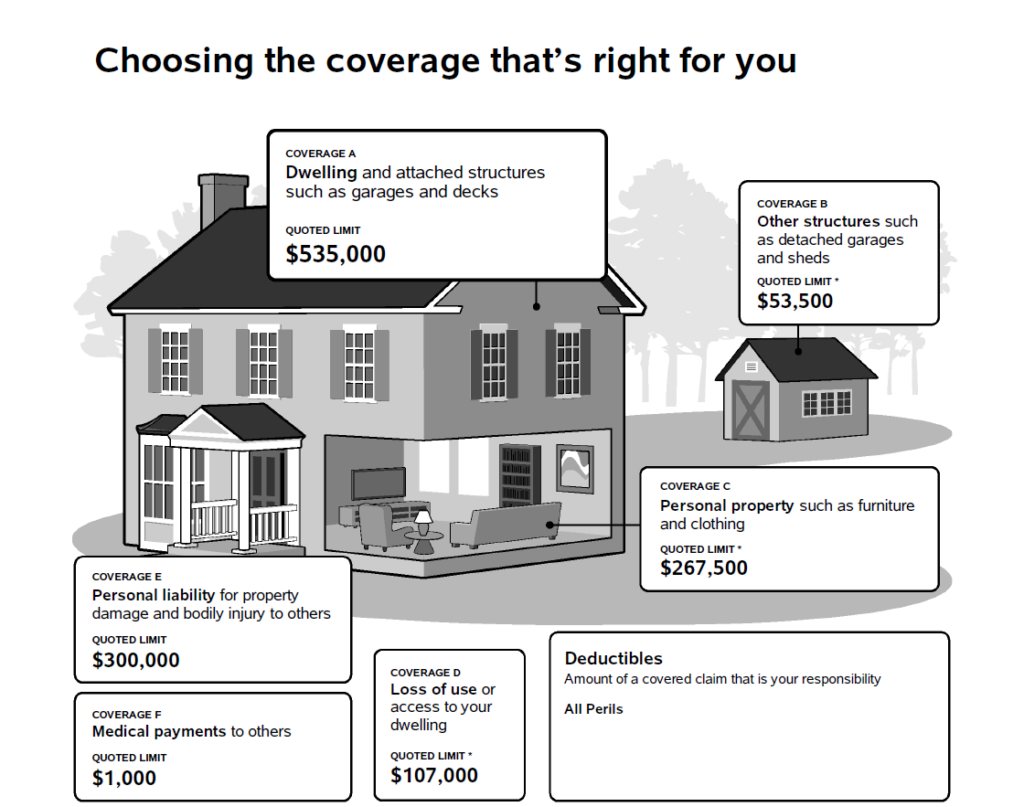

How do you value your home? It’s a simple question with a few possible answers. A large part of homeowners…

If you drive for Uber or Lyft in Virginia make sure you contact your auto insurance carrier or independent agent…

Depending on your home insurance carrier there are numerous optional coverages to choose from. One exciting package option is an…

Home insurance in Virginia doesn’t have to be complicated. If you’re first time homeowner, looking to upgrade, or purchasing a…

At Dove Insurance Agency our Family of Independent Agents are dedicated to serving you and working with your evolving lifestyle….